The cannabis industry, expected to generate $40 billion in economic impact by 2021, represents an enormous opportunity for a number of ancillary businesses – flavoring suppliers definitely included. While cannabis edibles might seem like the most obvious market for flavorists to make a play for, we believe cannabis concentrates are potentially more important because flavorings are a huge part of the concentrates experience.

This is because flavorings are a huge part of the concentrates experience. Concentrates actually appear in edibles, although standalone concentrate products are a much more likely avenue for flavorists looking to enter the market. Edibles are often flavored to mask the flavor of cannabis, whereas vaporized concentrate products tend to highlight them

Common terpenes like limonene (found in citrus) or beta-myrcene (found in hops) are definitely responsible for the distinct flavors that differentiate the strains, and those distinctions are even more pronounced when it comes to concentrates. This is because extraction technology has reached the point where individual molecules of cannabis can be separated and recombined, creating custom blends of THC, CBD, and terpenes.

Terpene Isolation and Flavor

Terpene isolation technology, a field pioneered by cannabis activist Kenneth Morrow, was discovered by accident while he was doing extractions. His extraction machine was malfunctioning, and when he contacted the manufacturer, they discovered that this was because terpenes were being released and fouling the extraction pump’s oil. He then built an attachment that allowed him to capture the isolated terpenes, and the field was born.1

Since then, the cannabis industry has developed varied methods of terpene isolation. As Leafly News writer Patrick Bennet concluded in a recent article about the future of terpene isolation,a “The technology and methodology exists on the open market for any enthusiast to experiment with.” Those technologies range from supercritical CO2 extraction to steam distillation.

There are even some companies who have already begun to market extracted terpene flavorings to the cannabis industry. The Werc Shop, a cannabis testing lab operating in Washington and California, offers both native and custom terpene blends, marketed via their Cannaroma brand. The Terpene Store is an online retailer specializing in sales of terpene blends designed to mimic specific strains of cannabis. They sell direct to consumer, but offer wholesale as well. However, the field is still relatively untapped.

Branded by Flavor

While many concentrates and vape products are still strain specific, meaning they are directly extracted from a specific strain and their flavor represents that strain’s natural terpenes, plenty more are branded by flavor (i.e. Chicken ’n’ Waffles, Watermelon, etc.), which means they use added flavoring. This could be construed as flavor masking, but because cannabis users generally enjoy the flavor of cannabis and because the extraction process is usually used to enhance or emphasize certain flavors native to cannabis, it would seem that non-cannabis flavorings aren’t used as masks.

Flavor aside, for cannabis users, the addition of specific terpenes is very important to the cannabis experience in general. Terpenes are thought to participate in what is called the “entourage effect,” or the idea that the experience of a unique strain of cannabis is based on its unique blend of terpenes and cannabinoids. This effect is even thought to be part of the medical potency of cannabis.

Thanks to this, as well as their importance to the aroma and flavor of cannabis, terpenes are becoming more and more important to consumers. This is even truer of the increasingly discerning consumers in legal markets, where labs are able to give producers specific terpene profiles for their products, enabling them to market products based on those results. Also Washington State regulators are currently the only ones to have weighed in on added flavorings for cannabis concentrates, and they opted not to regulate their use at all. While no state has explicit requirements that flavoring ingredients be listed on concentrate products, because of the buzz about the “entourage effect,” printing terpene profiles on cannabis packaging has become an increasingly popular marketing practice. For any terpene-derived flavorings, disclosing their presence is actually a benefit.

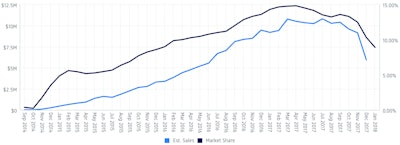

Thus, concentrates manufacturers have ample reason to want high-quality terpenes, be they synthetic or naturally derived, as consumers respond to them. Furthermore, the market for supplemental terpenes is not fully mature. At Headset, we offer real-time, data-based business analytics for the cannabis industry, and our data shows that concentrates are a growing category. While there are many suppliers marketing cannabis-specific terpenes, consumers in legal states have shown a remarkable tolerance for new concentrate products, which means there’s definitely space for new and innovative flavoring suppliers. In Washington, for example, the total number of concentrate products on the market grew from 4,850 to 8,835 in the second year after legalization (see F-1).

We think that terpene suppliers in a position to take advantage of economies of scale stand to benefit the most, especially as more and more states go legal. Many of the current terpene suppliers are essentially specialty retailers. Certainly in a cannabis industry the size of California’s, which licensed 400 cannabis businesses on its first day aloneb, there is plenty of room for larger players (see T-1).

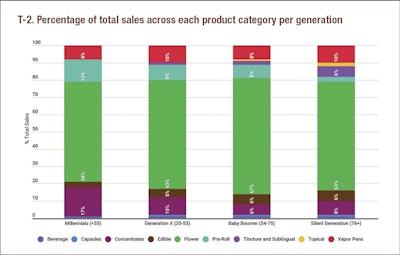

On a more granular level, our data also shows us that millennials seem to prefer concentrates (see T-2). Flower is, of course, the most popular category across all of our data, as it is the consumption method consumers most associate with cannabis. However, our Washington dataset shows that millennials’ second favorite product is concentrates. Millennials are considered the harbingers of sales trends for a reason, and their affinity for concentrates shouldn’t be taken lightly. As concentrates become more mainstream, we expect that older generations will give them a try, and our data shows that boomers are significantly less price sensitive than millennials. They can afford pricier concentrate products, even if they aren’t yet as enthusiastic about those products as millennials.

Whether or not a millennial preference for concentrates is a weathervane for the industry at large, we feel confident that the concentrates sector will continue to grow. And, given the close association between extracted cannabis products and terpenes, we think that as the category grows, so too will the demand for quality flavoring products.