The global fragrance industry sits well ahead of the wider beauty market, delivering consistent positive growth and a near unwavered upward trajectory. Outpacing the baseline beauty and personal care industry, a feat achieved by both color cosmetics and fragrances, fragrances experienced a renaissance in mature markets in the face of a fresh consumer desire to differentiate, while simultaneously gaining new adopters in rapidly advancing emerging nations.

The divergence of value and volume growth grew stronger over the past few years. Some of this inequity was a result of inflation in Latin American nations. However, the majority lay within premium’s remit and the growth in average unit prices thanks to a redefined niche genre of premium, which saw fragrances positioned as an investment piece, indulging a “less is more” mindset.

Brazil Shifts Volume, U.S. Churns Value

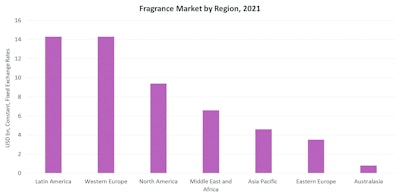

Regionally, Western European consumers as a collective represent the most valuable fragrance cohort. In individual market terms, the US followed by Brazil claimed the accolade of the largest fragrance nations.

However, the similarities end there. The importance of the US is attributed to a highly premium-leaning landscape, augmenting value gains, yet volume shift and spend per capita lag behind. Brazil breeds a reverse environment, where volume consumption is the highest in the world, balancing out its mass-centrism on the global stage.

Other notable nuances are the lack of market depth in Eastern Europe, compared with its Western counterpart, and Africa’s understandably sparse representation. Parts of Asia too are distinctly absent from fragrance coverage despite the region’s overall significance in beauty.

Regional Tussle Escalates

Developed regions remained the most sluggish, although they continued to gain value and Western Europe solidified its leading position. The biggest disruptor was Latin America, which after surpassing North America, continued to dwarf its neighbor’s global influence.

Outshone but not outdone by Latin America, the Middle East and Africa delivered strong growth, a region which is defined by two principal markets, South Africa and Saudi Arabia, and which is dependent on few but expensive purchases.

The underdog, Latin America, is poised to make a momentous leap through 2021, according to Euromonitor International, and draw level with Western Europe’s claim of leading industry value contribution (see T-1). A recuperating economy and sustained habit persistence following years of acquiring new and invested users are the triggers for the industry’s abrupt good fortunes.

Local Barriers to Emerging Markets

Together, the Middle East and Africa and Latin America will account for 57% of global fragrance gains through 2021, according to Euromonitor International, and naturally, any brand with growth ambitions will be eyeing up these two distinct regions.

However, competitive barriers are high and mainly exist by way of regional giants. These brands truly understand and are able to get under the skin of their local clients. The Middle East’s leading players specialize in oud-based scents, which are entrenched in the region’s culture and history, while the Latin American market is defined by natural and edible ingredients.

Brazilians are eager for novelty since fragrance is such a fundamental component of everyday personal hygiene; monotony can set in quickly. The likes of citrus fruits and vanilla are popular ingredients but international manufacturers must look to locally-sourced ingredients for these to compete with the regional experts.

Another obstacle in cracking Latin America is its mass-centricity, which characterizes the brand rankings. Premium players looking to penetrate should consider creating value beyond the product, through the store experience for example, which many of the leading mass players cannot replicate because they are direct sellers.

Smaller packs can also make premium choices more affordable, where even if consumption is less, the price per milliliter of a smaller bottle is typically higher, thus boosting value and unit price.

Seeking Silver Linings in Western Europe

Pivotal Western Europe will struggle to grow because it relies so heavily on repeat purchase and habitual usage, and lacks a strategy to acquire new adopters into the fold. Of the few forecast drivers of fragrances in the region, habit persistence will prove the most significant, while whole swaths of the population go untapped under the radar.

Western Europe has the oldest population in the world and it is continuing to age, heralding the need for multidimensional brand voices that target beyond the young. Many brands struggle due to their quest for breadth in customer profile but ultimately a narrow yet targeted message is more effective than a broad but irrelevant one.

Senior consumers have minimal grooming routines but the routines they do maintain are characterized by consistency and loyalty. The products that do tend to be adopted in this age bracket, have specific age or health claims. Therefore, targeting this group with ancillary line extensions that add an element of performance, such as calming or Ayurvedic properties, will elongate routines.

A Look to the Future: Asia Pacific’s Modesty Comes to the Fore

Latin America will remain the cornerstone of the fragrance industry through 2021 in value strength and resilient dynamism, according to Euromonitor International. Its mass-centricity is key in the polarity between premium’s forecast vigor and its more modest market value contribution.

Other regions start from a more balanced premium/mass base, meaning growth pace is more aligned with the expected value to be delivered. Asia Pacific’s modest absolute gains accentuate its humble fragrance beginnings and early stage of market development.

This is all the more stark in the context of the wider beauty industry, where Asia Pacific, namely China, tops most value projections due to the sheer size of the consumer base. Indicatively, market potential here remains vast.

Be sure to attend Hannah Symons’ keynote session, “The Future of Fragrance & Growth Opportunities”, at World Perfumery Congress on June 5 at 9:15 AM for more insights on the global fragrance industry.

For more information regarding Euromonitor International’s data, analysis or capabilities, please visit https://www.euromonitor.com/.