For the last seven years, Trendincite LLC has written several Perfumer & Flavorist “Forward Thinking” articles about different aspects of the natural fragrance and flavor market, and the trends discussed remain relevant. Driven by the health and wellness movement, the evolving consumer is much more ingredient-conscious and continues to seek better-for-you products. Consumers’ interest and demand for natural products persists. Trendincite’s most current articles Perfumer & Flavorist “Forward Thinking: Plant Power” article, which appeared in October 2017, examined plant-based market activity in a variety of food and beverage applications, while Trendincite’s Perfumer & Flavorist “Forward Thinking: By Nature,” article, which appeared in April 2017, discussed clean fragrances, natural deodorant, food grade beauty and natural beauty retailers.

The term “natural” is still not officially defined in the fragrance industry, and consumers’ confusion is apparent, yet their appetite for natural beauty products is not waning. According to a November 9, 2017, Cosmeticsdesign-europe.com articlea, Maria Coronado, Euromonitor’s senior ingredients analyst and doctor in chemical engineering, explained “The use of natural ingredients in formulations does not necessarily mean that the product is more sustainable, environmentally friendly or has less allergenic potential, it only means that it comes from nature. The allergenic potential of an ingredient depends on the properties of the ingredient itself and its interaction with other ingredients in the formulation rather than the source of the ingredient (natural or synthetic).”

Regardless of how consumers interpret natural, natural products continue to become mainstream and consumers expect products to be accessible. To meet consumer demand, new natural products including skincare, deodorant, hair care and fine fragrance are launching and driving innovation in consumer packaged goods.

A Sizeable Market

The growing demand for naturals is causing an uptick in the natural and organic market. According to Ecovia Intelligenceb (formerly Organic Monitor), the U.S. market for natural and organic cosmetics is the largest in the world, worth $4.5 billion in 2016, with a growth rate of 7% annually. According to Kline Groupc, manufacturers’ sales of natural personal care products reached $5.7 billion in 2016, which was up 9.2% from 2015. Furthermore, Allied Market Researchd, forecasts that the global organic personal care and cosmetic products market is expected to garner $19.8 billion by 2022, with a CAGR of 10.2% during the period 2016-2022.

Changing Consumer Behavior

Consumers are changing their beauty habits and are actively looking for more natural products across market categories. For example, Fraser Hill, Founder & CEO of Skinega, conducted a 64 people study and found that 84% of people agreed that products termed “natural” should mean 100% natural.

According to Kari Gran’s third annual “Green Beauty Barometer” surveye, conducted in partnership with Harris Poll, 69% of women age 35-44 say buying all-natural beauty products is important, up 10% since 2016, while 68% of women age 45-54 say buying all-natural beauty products is important, up 11% from 2016. Of women who will only buy naturals or plan to buy more naturals over the next two years: 38% will buy skincare; 31% will buy hair care; 30% will buy makeup (color cosmetics); 26% will buy sunscreen; 19% will buy fragrance and 20% will buy more natural nail care products.

According to data from the NPD Group’s “Women’s Facial Skincare Consumer Report 2017f,” 40-50% of women actively seek natural or organic ingredients in their facial skincare products, and those free of ingredients including fragrances, parabens, phthalates, sulfates and gluten. Among facial skincare users, 50% typically use skincare products that are hypoallergenic / formulated for sensitive skin and fragrance free (compared to 47 % in 2015); 48% usually look for products that are made from natural/organic ingredients (43% in 2015) and 40% usually buy products that are free of parabens, phthalates, sulfates and/or gluten (33% in 2015).

Beneath the Surface

According to Kline Group’s 2016 datag, skincare represents 43% of natural beauty care sales, while hair care represents 15%. It is reported that as much as 60% of what is applied to an individual’s skin is absorbed into the bloodstream, and this statistic is often used to influence consumers to try natural skincare products. There has been an influx of independent brands formulating new skincare products with natural claims.

In 2012, ER doctor Sarah Villafranco left medicine and founded Osmia Organics, a self-described “health style brand.” Inspired by Villafranco’s medical background, the brand has a “Tox Screen” label on its products with a list of ingredients that the products do not contain including parabens, phthalates, sulfates, petrochemicals, ethoxylation ingredients and synthetic color or fragrance. In 2016, the brand changed its name to Osmia and repackaged its line using many recyclable and sustainable materials. The brand’s Black Clay Facial Soap is a bestseller and is formulated with black Australian clay, Dead Sea mud, organic almond, avocado, castor bean oil and coconut milk. Ronnie Klein, a board-certified Yale-trained dermatologist, recently launched Pure BioDerm, a clean skincare range free of synthetic fragrance and dyes, parabens, sulfates, silicone, phthalates, petrochemicals, formaldehyde, formaldehyde releasers and GMO ingredients. The first product is B5 Hydrating Serum, which highlights U.S. sourced vitamin B5, hyaluronic acid, apple polyphenols, arnica, licorice, willow bark and cucumber extracts. Additional products are expected in early spring 2018.

Skinega is a “luxury, vegan skincare brand” that formulates with botanicals and actives, which are naturally derived from nature or molecules naturally found in your skin (bio-identical) and no synthetic thickeners, colors or fragrances. Targeted for women ages 30+, in June 2017, the brand debuted Serumizer “a youth maintenance, oil-free, scent free serum with only eight active ingredients,” including Skinega’s proprietary Quad Weight Hyaluronic Acid™ (QWHA). In April 2017, Planted In Beauty by Well Within introduced a collection of plant-based skincare “derived exclusively from natural sources and containing the highest level of organic ingredients, while remaining completely free of chemicals and toxins.” To be transparent and provide assurance, the brand holds several certifications, including Ecocert and COSMOS cosmetics standard, EWG-verified, Leaping Bunny and Vegan Action. Biossance is a clean beauty skincare line based on plant derived Squalane harvested from sugarcane. The brand formulates using a “No Compromiseh” blacklist of 2,000+ ingredients and all products are EWG-verified. The newest addition to the line is Biossance Phyto Retinol Serum, which is a “natural and gentle alternative for the traditionally harsh ingredient retinol.” The brand’s products are packaged in recyclable bottles and the outer packaging is tree-free and made from sugarcane paper.

Launched in 2017, the Sleep Over Stick is a convenient two-step natural facial cleanser and moisturizer. The products are formulated with 85% organic ingredients and are cruelty-free, PETA approved and travel TSA friendly. The Cleanse Stick includes organic coconut flour as mild exfoliant and organic shea butter to retain moisture, while the Hydrate Stick features organic rosehip seed oil, organic jojoba oil and calendula oil. The cleanse stick can be used as shave soap for men, while the hydrate stick doubles as a primer for makeup touch-ups. According to the company, each stick lasts for up to 40 applications.

LalaLucia Fresh Beauty is a “clean, plant-based, natural skincare line formulated for teen girls (and their Moms),” which launched at the end of January 2018. The brand was developed because founder Jana Soiseth could not find a natural product that was designed specifically to address her teen daughter’s or her own hormonal breakouts. The products are vegan, cruelty-free, paraben-free and free of harsh synthetic chemicals as well as packaged and shipped in recyclable materials. Clarifying Clay Mask with Papaya and Pineapple Extracts (for teen skin or mature skin), Rejuvenating Clay Mask with Goji Berry and Maca Root (for mature skin) and A Clearing Night Serum (for teen skin) are three of the 14 SKUs available. C’est Moi is a new 38 SKU skincare and color cosmetics line designed for young girls and their “delicate skin types,” which launched at the end of January 2018. The brand uses gentle ingredients such as aloe, calendula, strawberry extracts, cucumber, kiwi, apple, chamomile water, organic sweet almond oil and shea butter. In addition, the brand adheres to a strict “NO WAY” list that documents over 1,400 banned ingredients in the European Union (EU) and 30 current banned U.S. ingredients.

Under the Hilton Lifestyle, LLC brand, Paris Hilton released the brand’s first product Unicorn Mist Limited Edition - Rose Water facial spray. The product contains arctic rose extract, aloe vera juice and Althaea officinalis (marshmallow) and is free of parabens, preservatives, formaldehyde and sulfates. According to the company, a full line of natural skincare products is planned for early 2018.

Natural Pits

The U.S. deodorant market has been traditionally dominated by antiperspirants to stop wetness and perspiration. With consumers’ increased awareness and scrutiny of ingredients, natural deodorants that are aluminum-free are being sought. In response, natural deodorants are becoming more mainstream and available. In Europe, deodorants are more common than antiperspirants and naturals are expected. According to GlobalData’s 2016 researchi, natural is an important claim for European consumers, with 57% saying they are interested in and already buying natural beauty/grooming products.

Earth Mama, the Portland-based company debuted Organic Deodorants, which are formulated especially for those who are pregnant, breastfeeding or have sensitive skin. The deodorants are offered in four scents: Bright Citrus, Calming Lavender, Ginger Fresh and Natural Non-Scents. According to the company, the products are certified by Oregon Tilth and are formulated with organic essential oils and do not contain propylene glycol, parabens, aluminum or any form of fragrance.

Fatco, the Paleo-certified brand, uses tallow from grass-fed cows as the flagship ingredient in the majority of its 40 SKU natural, handmade skincare line. The brand does not use stabilizers or preservatives, and in January 2018, it rolled out four of its natural beauty products at 450 of Target’s retail doors. The natural deodorant Women’s Stank Stop is Fatco’s bestseller and is one of Target’s four offerings. A recent addition to the brand’s lineup is Stank Stop in a Tube, which is the same formula that includes organic coconut oil, aluminum-free baking soda, grass-fed tallow and shea butter, with “a new and approved applicator.”

Similar to the activity of plant-based food and beverage acquisitions, large consumer packaged goods manufacturers are purchasing natural deodorant brands. In November 2017, Procter & Gamble acquired Native, the natural deodorant direct-to-consumer brand and in December 2017, Unilever announced plans to purchase natural deodorant brand Schmidt’s Naturals, which is expected to close in the first quarter 2018. These recent acquisitions are a telltale sign of the importance of natural deodorants. Although not specifically deodorant brands, in September 2017, SC Johnson, announced that it had signed an agreement to acquire Method and Ecover, two consumer brands known for their environmentally friendly products and packaging, which offer home care, hand and body and laundry products.

Fresh Meat Masculine Wipes by Scotch Porter launched in November 2017 with the kitsch “Eliminate the Funk From Your Junk” slogan. The wipes are designed to freshen men’s genitals and are gentle on skin, infused with aloe, vitamins B, E and free of parabens, phthalates, chlorine, formaldehyde and alcohol. According to the company the product contains notes of leather, black peppercorn, patchouli, musk, citrus and warm woods. The product can also be used on underarms, feet and other body parts that need refreshing.

Hair Today

Hair care is following skin care and there has been a variety of activity in natural hair care introductions. At the beginning of 2017, Procter & Gamble introduced Herbal Essences Bio: Renew. The nine variant collection features shampoos, conditioners and styling products, which are based on a signature blend of essential antioxidants, histidine (an amino acid that is derived from fermented corn sugar), aloe and sea kelp with 0% parabens, gluten or colorants. At the beginning of 2018, Herbal Essences added Bio: Renew Foam Conditioners in four variants: Blue Ginger, Green Tea & Cucumber, Rosemary & Herbs and White Grapefruit & Mosa Mint.

In 2017, Aveda, a pioneer in natural hair care products, unveiled Pure-Fume Hair Mists in three scents: Alanara, Marassona and Mihana, which arepredominantly made with certified organic plant-based ingredients. NatureLab, a Japanese beauty company specializing in botanical stem cell beauty, launched a collection of four plant-based hair care lines in the U.S. Perfect Shine includes a shampoo, conditioner and oil mist, which are formulated with grape stem cells, platinum fiber, pearl extract and hyaluronic acid. Perfect Volume is made up of shampoo, conditioner, blowout jelly and texture mist with rice and soy proteins and apple stem cells. Perfect Smooth features ashampoo, conditioner, blowout lotion and hair oil and contains Yuzu ceramide, argan stem cells and quinoa. Perfect Repair highlights a shampoo, conditioner and treatment masque with Bamboo stem cells and prickly pear oil.

In March 2017, L’Oréal Paris debuted Botanicals Fresh Care, a premium hair care brand inspired by nature launched in France, Germany and the UK. The products are silicone, paraben and dye-free and use a coconut and soy-based botanical complex to protect the hair without greasiness or heaviness. The containers are made of PET, which is 100% recycled and recyclable. In December 2017, L’Oréal announced the launch of Botanea, a new professional vegan salon hair dye. The three products: Pure Cassia, Pure Henna and Pure Indigo are formulated from plants found in India and are expected to rollout in salons across Europe in May 2018. The company received backlash from animal rights activists for labeling the line vegan, while the company allowed its products to be tested on animals.

To compete with small, indie brands and address consumers seeking natural ingredients paired with the efficacy of science, Unilever introduced ApotheCare Essentials in November 2017. The 17 SKU science-forward personal care line, which includes shampoos, conditioners and body products, was developed in a little over a year with a core team of seven p eople. The brand was formulated with six base ingredients and four fragrances (geranium, jasmine, lavender and vanilla) and combines science and nature with a “Purity of Nature. Progressed by Science.” tagline. Initially the brand launched at CVS stores and in January 2018, the distribution widened and is now available online at Amazon.

In December 2017, Unilever announced the launch of Love Beauty and Planet, a new vegan brand. The 20-plus product range launched in January 2018 and is available in most mass retailers. According to the brand, the products are not tested on animals and do not include silicones, parabens or dyes. Each range includes organic coconut oil and is infused with a signature natural ingredient. The fragrances are from ethically sourced essential oils and the packaging is made from 100% recycled plastic and is 100% recyclable. There are six collections: Argan Oil & Lavender, Coconut Oil & Ylang Ylang, Coconut Water & Mimosa Flower, Murumuru Butter & Rose, Shea Butter & Sandalwood and Tea Tree Oil & Vetiver.

Natural and vegan UK brand Noughty announced it will release four new product ranges in the first quarter of 2018. Blondie Locks Shampoo and Conditioner, Colour Bomb Shampoo and Conditioner, Noughty Co-wash Cleansing Conditioner, and Pumped Up Shampoo and Conditioner are all 97% natural, vegan friendly and contain no parabens, petrochemicals, sulfates or silicones. Creme of Nature recently released seven new styling products under its Certified Natural Coconut Milk Collection and all products are infused with coconut oil.

Fragrant Essential Oils & Botanicals

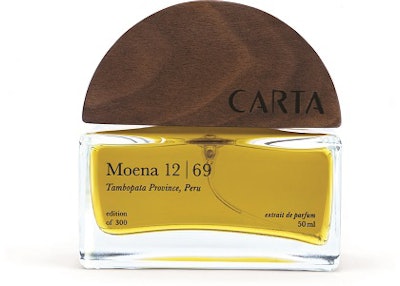

According to Transparency Market Research (TMR)j, the natural fragrance market is projected to be worth $5.3 billion by 2024. Fine fragrances with a focus on essential oils and botanicals are emerging as consumers’ quest for natural products escalates. Fashion designer Behnaz Sarafpour, the Iranian-born designer who uses organic fabrics and sustainable techniques in her collections, debuted Behnaz fragrances. The Natural Hair & Body Fragrances are available in Pure Rose and Pure Neroli. The only ingredients used are the organic flower essences and distilled water. The products do not contain alcohol, oils, dyes or preservatives. Artisan perfumer Janna Sheehan crafted the Ojai Wild natural fragrance collection formulated with natural ingredients from native California botanicals, resins, woods and roots. There are four eau de colognes available: Juniper Berry, Pink Peppercorn, Redwood Leaves and White Sage Leaves and the bottles are topped with reclaimed wood caps crafted by Rob Bezrutczyk and Cole Bennett. San Francisco-based perfumer, musician and ecologist Heather D’Angelo launched Carta,a new fragrance brand. Moena 12|69 is the brand’s first fragrance featuring its signature ingredient Moena Alcan for, an essential oil distilled in the Peruvian Amazon. "Carta" means map in Italian and the numbers in the name refer to the geographic coordinates from where the oil was sourced. Moss, ginger, brewed tea and tobacco leaves are additional fragrance accords, which create a warm, woodsy and unique scent. Moena 12|69 is available in a limited edition run of 300 bottles and only owners of this exclusive $295 scent can reorder in the future. The bottle cap is sculpted by Wood Thumb and is crafted from reclaimed walnut wood.

Boulder, CO-based personal care brand Goddess Garden entered the fragrance category and rolled out five essential oil roll-on perfumes. Amber Fire, Citrus Sunrise, Lavender Sky, Rainforest and Wildflower are each made with certified-organic essential oils. In addition, the brand debuted three wearable aromatherapy bracelets and five bracelet essential oil blends. The bracelets are available in three styles, which feature porous lava rock and an energetic stone that act as a diffuser. Ambition highlights howlite, while Perseverance is designed with unakite, and Serenity has turquoise. Phlur, the digital-only sustainable and transparent fine fragrance brand has added a candle line extension. The three candles are translations of current fragrances: Annica inspired by Hanami fragrance; Claremont inspired by Olmsted & Vaux fragrance and Howl inspired by Hepcat fragrance. Packaged in reusable ceramic vessels the hand-poured candles are “cruelty-free and free of parabens, phthalates and animal products” and formulated with a blend of 80% vegetable wax and 20% food-grade paraffin.

Parfums Mugler and Azzaro of the Clarins Fragrance Group have initiated an environmentally friendly and sustainable way to produce the alcohol used in the brands’ perfumes. Located on the Remicourt farm in France’s Champagne-Ardenne region, the companies have planted a variety of trees and shrubs specially selected to contribute to sugar beet cultivation, creating a sustainable system that protects and regenerates the environment, as well as ensuring optimal production of the sugar beets for perfume alcohol. In October 2017, at the California SCC Suppliers Day, Miriam L Vareldzis, founder/creative director of Palette Naturalsk, debuted a portfolio of 100% natural perfumery blending accords that offer transparent ingredient lists and are compliant with the ISO 9235 definition of aromatic natural raw materials. Designed for formulators, chemists, contract fillers, beauty entrepreneurs and perfumers, there are 14 accords in the range that span a variety of olfactive families including citrus, green, floral, spice, amber balsamic, amber gourmand and woods.

“The collection serves to expand the palette by offering the building blocks of natural perfumery development. Since there are no minimums, Palette Naturals is especially helpful for those who cannot meet the minimums of larger fragrance houses,” said Vareldzis.

Store Front

Independent retailers continue to cater to consumers by offering a selection of natural beauty products. San Diego-based Shop Good, originally an online clean beauty retailer, launched in 2015, and in 2017, the brand opened its first brick and mortar store. Neom Organics, the natural UK brand that promises “100% natural fragrances made in Britain from ethically sourced, sustainable origins, only natural and organic ingredients, no petrochemical paraffin or mineral wax, no artificial perfume only pure essential oils and no harsh preservatives,” has launched the brand’s third shop in central London. The new store features a Scent Discovery Bar, an event space for workshops, schools and classes as well as wellness and lifestyle literature library space and personalized well-being consultations. California-based non-toxic nail brand Côte opened its first East Coast shop in New York City’s East Village neighborhood. The brand offers manicures and pedicures using its signature 10-free nail polishes, which are cruelty-free and vegan. To appeal to busy on-the-go customers, the shop offers the “Quick Cote,” a 15-minute express service that includes a basic polish change, argan oil and a SPF to protect your hands.

Global Growth

Consumers’ interest in natural beauty products is a global phenomenon driving market growth in other countries. Germany’s natural and organic market share is approaching 10% of the total personal care products market, while UK represents 3% and Asia’s market share is below 1%, according to Ecovia Intelligence.l According to Euromonitorm, Asia Pacific and the Middle East and Africa will drive the demand for essential oils in beauty and personal care products between 2016 and 2021, with CAGRs of 4% and 5%, respectively. The demand for essential oils will be driven by skincare in Asia Pacific while bath and shower products are the drivers in the Middle East and Africa. According to Indian Beauty & Hygiene Association’s reportn, the Indian beauty and personal care market is worth about $8 billion and is expected to grow to $10 billion by 2021. In addition, the all-natural beauty product market, which comprises one third of the personal care market, is growing 2.5 times faster than the market for non-natural beauty products. Furthermore, India’s natural and organic personal beauty care products market is expected to grow during the forecast period of 2017–2022 at a 17.27% CAGR, according to Research and Marketso. Tech Sci Researchp, forecasts the Indian ayurvedic market to grow at a CAGR of 16% through 2021.

Future of Naturals

The natural evolution is here and has sustainable growth in established markets and high growth potential in emerging markets. A variety of industry brands and experts believe naturals will continue to evolve. To compete in the green beauty space, brands will have to come up with better messaging about naturals, according to UK trend forecasting agency The Future Laboratory. The agency predicts that “zero irritants” and “irritant-free” will be key beauty buzzwords and cites brand Peet Rivko as an example. Erica Parker, esthetician and education director at Michael Todd Beauty, expects to see the continuation of efficacious active ingredients and the replacement of potentially toxic ingredients with more eco-friendly alternatives and cleaner preservatives based on natural ingredients. Cassy Burnside, founder of Fatco, believes baking soda-free natural deodorant choices are poised to flood personal care departments as are deodorants suited to specific skin types and concerns. As for packaging, Marie Lavabre, founder of Kinn, the organic lifestyle brand, foresees a shift towards plant-based plastics and glass.

Scrutinizing labels is the new norm and consumers will continue to be increasingly selective about the ingredients that they expect and will use in their products. Better natural products with similar sensory experiences and functionality to synthetic products are being developed as science and technology advance. Consumers and brands will continue to invest in natural products providing opportunities and challenges for fragrance houses and consumer packaged goods manufacturers.