U.S. prestige beauty sales rose 8% in the first half of 2024, totaling $15.3 billion, while mass beauty remained flat year-over-year, totaling $30.4 billion, per new Circana data. To compare, NIQ puts the growth rate at 5.5% in the same period. Based on its data, "Circana is forecasting growth in prestige beauty for 2024, with continued growth through 2026, albeit at a slower rate," says Larissa Jensen, global beauty industry advisor at Circana. Globally, NIQ data shows that beauty dollar sales grew 10% in all regions, led by Europe and APAC, which were boosted by an expansion of ecommerce and social selling in China and South Korea in particular (more on that below). Here, we break down the latest global and U.S. data points from Circana and NIQ and what they mean for retail and product trends across categories, including fragrance, hair care, skin care and color cosmetics.

Log in to view the full article

U.S. prestige beauty sales rose 8% in the first half of 2024, totaling $15.3 billion, while mass beauty remained flat year-over-year, totaling $30.4 billion, per new Circana data. To compare, NIQ puts the growth rate at 5.5% in the same period. Based on its data, "Circana is forecasting growth in prestige beauty for 2024, with continued growth through 2026, albeit at a slower rate," says Larissa Jensen, global beauty industry advisor at Circana. Globally, NIQ data shows that beauty dollar sales grew 10% in all regions, led by Europe and APAC, which were boosted by an expansion of ecommerce and social selling in China and South Korea in particular (more on that below). Here, we break down the latest global and U.S. data points from Circana and NIQ and what they mean for retail and product trends across categories, including fragrance, hair care, skin care and color cosmetics.

Beauty's Ecommerce & Social Selling Boom

According to NIQ data, online beauty sales grew 14.1% over the last year, helping to drive 8.5% growth in the beauty market, which the firm values at $104.9 billion.

Online sales gains have been particularly strong in China and South Korea, which drove 12.3% growth for APAC. Other ecommerce leaders include Germany and Spain.

For the first half of 2024 alone, 41% of all beauty and personal care sales took place via ecommerce, which NIQ says is evidence of consumers' blended shopping behavior between online and brick-and-mortar.

Social selling platforms such as TikTok Shop, Temu, Ebay, Poshmark, Mercari and Shein have collectively captured 6.2% of the total e-commerce market, per NIQ; TikTok leads with 2.6% market share, followed by Temu, with 1.5%.

TikTok charted 50% growth in China, per NIQ, helping drive double-digit sales growth in the market (that said, China's prestige space has been challenged, as seen with Estee Lauder financial results).

US Beauty Consumers Seek 'Elevated Value' in 2024

In 2024 so far, premium hair care, value-centric fragrances, body skin care, lip makeup and several other categories have propelled growth.Carlo at Adobe Stock

In 2024 so far, premium hair care, value-centric fragrances, body skin care, lip makeup and several other categories have propelled growth.Carlo at Adobe Stock

She adds, "Total U.S. consumer spending at retail is flat, but beauty growth continues and prestige beauty specifically continues to be one of the fastest growing industries across the general merchandise and CPG markets."

Jensen concludes, "While consumers may trade down in other areas, within beauty they continue to spend in prestige as the mass market experiences unit sales declines. Interestingly, within the prestige market we see a consumer looking for value though lower-priced brand and product options."

Prestige Fragrance Leads 2024 US Growth

“An accelerated bifurcation is emerging in the beauty industry highlighted by the continued strong growth in prestige in relation to the mass market,” said Larissa Jensen, global beauty industry advisor at Circana.Circana

“An accelerated bifurcation is emerging in the beauty industry highlighted by the continued strong growth in prestige in relation to the mass market,” said Larissa Jensen, global beauty industry advisor at Circana.Circana

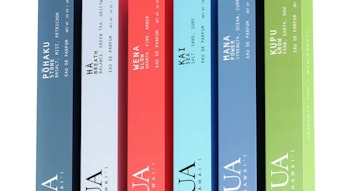

Top fragrance growth engines included:

Power Sells: Eau de Parfums and Parfums

This is not a new phenomenon. In 2023, Circana reported that higher fragrance concentrations such as eau de parfums and parfums gained three share points. These two product types are leading fragrance growth and rising prices.

Small is Big: Mini Sizes/Travel Sizes

This is also not a new phenomenon. Last year, Circana reported that unit sales for mini women’s fragrances grew at five times the rate of other sizes. For the first half of 2024, units sold for mini scents grew at twice the rate of the fragrance category.

Body Sprays Signal Value-seeking

Body mists and sprays, which feature average prices under $25, more than doubled in sales revenue since the first half of 2023. This trend has continued over the last year-plus, driven by Gen Z.

Gen Z Drives Dupes

Fragrance dupes continue to be a Gen Z favorite. A recent Circana analysis noted that scent dupes offer a similar fragrance experience as a luxury or niche brand, but at a fraction of the cost. These lower cost alternatives are more visible and discoverable than ever, thanks to #PerfumeTok and high Gen Z engagement in the fragrance category.

Gen Z is reportedly "twice as likely to be influenced to purchase a scent that is a dupe or inspired by a more expensive scent," per the Circana analysts, in part because these shoppers believe that lower cost fragrances can be just as good as their more premium counterparts.

In 2024, the dupe culture trend is a "bright spot in the mass fragrance market," with private label brands growing more than 50% year-over-year. Many are marketed as equivalents to luxury and prestige brands.

US Hair Care is Driven by Premiumization in 2024

Hair product sales in the prestige market increased by 10%, based on dollars. Notably, hair products with average prices above $30 grew 3x the rate of lower priced items and now account for 25% of unit sales for the hair care category. That's a 10% gain of market share in just the last three years.

Mass hair care also experienced the largest growth compared to other categories tracked in the Circana report.

Hair care is also the only category with the majority of its sales coming from ecommerce, per Circana. Sales in that channel are experiencing double-digit growth.

Meanwhile, styling and treatments were the fastest-growing areas of the category. In 2023, Circana reported double-digit growth in most hair styling segments.

US Body Care Dominates 2024 Skin Care Sales

Prestige skin care dollar sales increased by 7% in the first half of 2024, leading growth in units sold.

Body skin care is the fastest-growing sector of the overall category, driven by body spray sales, which have grown in the triple digits in the first half of 2024. Double-digit growth has also been seen for body creams, lotions and cleaners.

Per Circana, consumer spending on prestige body products increased by 25% and there are 17% more buyers in this market than there were last year.

Lips & Unique Formats Drive 2024 US Makeup Sales

While prestige makeup remains the largest category in the prestige market, its sales grew 5%, slower than the other categories tracked in the Circana report.

Prestige lip segment sales grew in the double-digits, led by balms and oils. Furthermore, lip gloss and liner were top sales gainers in the mass sector. This lip makeup boom is not a new phenomenon, carrying over from 2023.

Other top performers include unique formats such as:

- liquid blushes, sticks and balms

- liquid bronzers

- stick foundations

- stick eye shadows

Innovation Whitespace for 2025 & Beyond

NIQ's report offers a few growth areas brands can pursue for growth in 2025 and beyond. These include:

- Products with health & well-being facets paired with aesthetic payoffs

- Transparent brands focused on efficacy

- Inclusive, customized brands focused on specific skin types and tones, concerns, etc.; these brands may tap AI and other emerging technologies to ensure optimal pairing of consumer and product/regimen

- Beauty dupes that deliver performance on par with benchmarks for a lower price