The COVID-19 pandemic had a negligible impact on the global beauty and personal care industry (at fixed USD current terms) as growth in skin care and bath and shower offset the negative impact from other categories. But sales bounced back strongly with double-digit growth between 2020 and 2022, driven by remarkable performance in fragrances. Globally, the fragrances industry is expected to record a 4% CAGR between 2023 and 2028 (in USD fixed constant terms), following a 14% year-on-year increase in 2023a in current terms. This can be mainly ascribed to a change in fragrance usage patterns. Earlier being positioned for out-of-home occasions, fragrances’ role has shifted towards wellness and emotional well-being, especially after the pandemic. The trend shows no sign of a slowdown as habit persistence in fragrances continued into 2024.

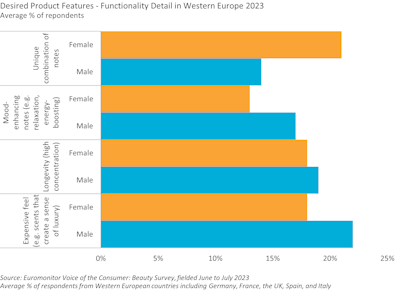

Female and male consumers differ in desired functional demands in fragrances, while personalization remains popular among younger generations (T-1).

A deep dive into consumer preferences in fragrance purchases highlighted notable distinctions in how men and women prioritize specific functional details.

Based on the Euromonitor Voice of the Consumer: Beauty Survey, fielded June to July 2023, male consumers in countries including Germany, France, the UK, Spain, and Italy ranked expensive feel, longevity, then mood-enhancing as top fragrance functional features. Female consumers, on the other hand, placed higher priority on unique combination notes, and expensive feel, then longevity.

Demand for unique or customized fragrances is increasing, especially from young consumers, as fragrance is becoming a way to express individuality or be recognized in the crowd. Industry players are recognising this trend with new product developments. For instance, Estée Lauder Cos Inc is working with AI technology to offer personalized fragrance recommendations based on an individual’s neurological reactions. In the near future, it is expected that consumers will look for ways to build a stronger and unique scent, and layering is just one way to achieve this.

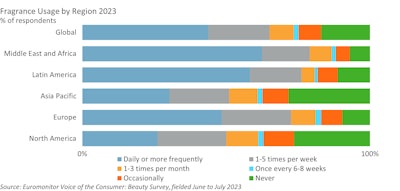

High daily fragrance usage in Europe is reflected by frequent purchase habits

According to the Euromonitor Voice of the Consumer: Beauty Survey (T-2), fielded June to July 2023, fragrance usage is a daily ritual for 44% of people worldwide—with highest usage levels in the Latin America and Middle East and Africa regions. However, Europe reflects significant daily usage. About 24% of the respondents in Europe mentioned using fragrance 1-5 times per week—the highest rate when compared with other regions. Western Europe accounts for the biggest value share in the global fragrances market – 28% in 2023.* Following the pandemic period, sales of fragrances in Western Europe grew at double-digit rates in all years. About 80% of the Western Europe fragrances industry is dominated by five countries – Germany, France, the UK, Spain, and Italy. Increased unit price and strong demand for premium fragrances are pushing up the overall market value in the region, but in volume terms consumer purchasing behavior differs across markets and among consumers.

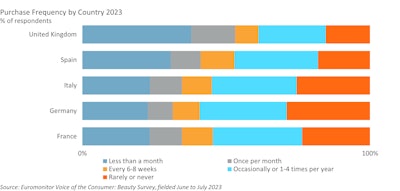

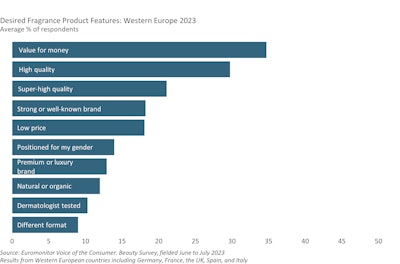

The Euromonitor Voice of the Consumer: Beauty Survey, fielded June to July 2023 (T-3), indicates that the UK leads with over 50% of respondents mentioning purchasing fragrances frequently during a month, followed by Spain. Demand for fragrances continued as consumers returned to normal life with the reopening of offices and increased social events, while on the supply side retailers adopted various strategies to boost volume sales. For instance, UK-based perfume retailer The Perfume Shop introduced a price freeze campaign on over 100 fragrances to support consumers amidst the cost-of-living crisis in 2023. Premium traits remain a top priority for Western European fragrance shoppers Since a consumer’s purchase frequency is often influenced by the perceived value of product features, it is crucial to analyze product feature preferences to understand consumer behavior as well as evolving consumer demands. Based on the Euromonitor Voice of the Consumer: Beauty Survey, fielded from June to July 2023 (T-4), a majority of fragrance consumers in the top five Western European markets voted for premium quality traits as one of the preferred product features. Value for money, high quality, and super-high quality are amongst the top desired fragrance features in Western Europe.

With about an 83% share in the total Western Europe fragrances market, the premium segment drives the growth with 12% year-on-year growth in 2023* (current terms) and a 4% CAGR at constant currency in the forecast years through to 2028. The ongoing premiumization trend in the beauty and personal care industry has further pushed the demand for luxury products. In 2023, Victoria Beckham debuted in the fragrance business by launching three luxury unisex fragrances worldwide, which helped elevate the positioning of celebrity fragrances. Fragrance is becoming an affordable gateway for consumers to invest in luxury collectibles and is considered a small luxury and an indulgence. Amidst the high cost-of-living crisis, consumers look for value-added products irrespective of their current market positioning – premium or mass.

Premiumization merges with sustainability as demand for sustainable fragrances continues to grow Leading brands in the premium segment are already offering added benefits over and above high-quality products. This comes in the way of new formats and packaging such as refillable bottles which are gaining popularity. France is one of the biggest markets for refills and rechargeable products globally. Many brands and retailers are catering to this consumer demand. For instance, in 2023, L’Oréal strategized to expand its refillable fragrance range by partnering with The Perfume Shop to set up a multi-brand fragrance refill station in its UK-based stores; also in 2023, Marc Jacobs launched Daisy Drops which is a compact gel-like fragrance formulation in sustainable capsule packaging. Natural and premium ingredients are highly associated with the perception of premium beauty/traits. According to the Euromonitor Product Claims Tracker, natural and environment-friendly are the leading sustainable attributes for fragrances across the key Western European markets. The industry is witnessing significant investment and new product development in this space. In 2023, L’Oréal partnered with Cosmo International Fragrances (a global fragrance company) to use its Green Sciences-based technology to extract fragrance from natural ingredients. Symrise (a German fragrance and flavor-producing company) offers the Lilybelle fragrance ingredient which is a sustainable, biodegradable, and upcycled product from the orange juice industry. It also won "Best Sustainable Ingredient for Fragrance" at the Barcelona Perfumery Congress in 2023. Furthermore, Coty’s initiative to use carbon-captured alcohol for its fragrances and Chanel’s replacement of galvanized brass bottles with an anodized aluminum strip in its Chance packaging in 2024 serve as great examples of reducing environmental impact.

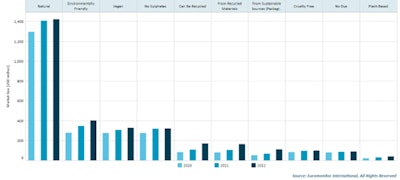

Top 10 Fragrance Attributes Market Size in Western Europe

The Euromonitor Sustainability Product Claims Tracker (T-5) estimates retail value sales for products with each sustainable attribute across categories and countries. The market size of fragrances with the “natural” attribute recorded a 5% CAGR between 2020 and 2022, while the “environmentally friendly” claim in the fragrances market size marked a 22% CAGR between 2020 and 2022. Environmentally friendly and other sustainable claims will lead fragrance innovation in 2024, boosted by a higher consumer appetite for fragrances that have premium and sustainable features, contain functional ingredients, and deliver longevity and efficacy.

For more insights on fragrance claims, please register for the Which Claims are Winning in Fragrances session at the World Perfumery Congress event (24-27 June 2024) by visiting www.worldperfumerycongress.com. Use code THYMESUP for a discount on unfinished and new registration!

Footnote

aAll market data involving 2023 (excluding survey data) are preliminary. Final data will be published in April 2024.