During comments at this year’s Fragrance Materials Association winter meeting, Leslie Smith, vice president of fragrance technology and development at Coty, defined his equation for fragrance success: good concept, good fragrance oil—usually, and great packaging and advertising/promotion. In terms of the fragrance oil, Smith outlined his three pillars of success:

- Performance: the use of physical and chemical techniques to change the way a fragrance performs whether through encapsulation, film forming or some other form of fragrance engineering.

- Emotion: taking measurements of how the brain reacts to fragrance, utilizing mood measuring techniques to anticipate consumer needs, and enlisting complex analytical tools to provide perfumers with insights into the composition of winning fragrances.

- Added benefits: active fragrances (deodorant, anticellulite, antioxidant, etc.), green claims that can be beneficial to positioning of products, and skin care benefits derived from targeted cell science/human stem cell research.

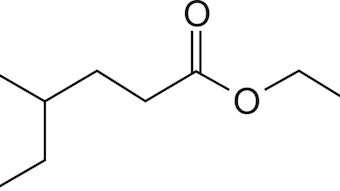

New molecules, Smith added, are also indispensible in achieving new olfactive directions, and replacing scarce naturals (alone or in bases) or problematic ingredients. Here he presented a timeline of innovative molecules: aliphatic aldehydes (1921; featured in Chanel No 5), Hedione (Firmenich, 1966; featured in Eau Sauvage), Iso E Super (IFF, 1974; featured in Halston), Z11 (2001; featured in Light Blue) and Pear Natureprint (Firmenich, 2005; featured in Happy to Be). New materials, Smith added, don’t just aid new launches, but also allow for the reengineering of classic fragrances.

Fragrance Life Expectancy

Amidst talk of innovation, Smith acknowledged the perception that only about one in 10 fragrances survive today’s marketplace after two years. He presented projections that, extrapolating from current conditions, the fragrance market could witness approximately $4.1 billion worth of men’s and women’s fragrance sales in 2012. Yet Smith was sanguine, presenting data that showed the survival rate for fine fragrances after two years holding at 79%. And of the remaining 21% of launches, he said, many feature built-in obsolescence, such as seasonal editions, flankers and anniversary editions. “It’s not as negative as it might come across initially,” he noted. Meanwhile, said Smith, “The classics remain classics.” Many of these fine fragrances, he explained, still net sales of nearly $100 million a year and rather predictably cycle in and out of top five sales lists around the world.

Natural/Organic Challenges

“The finished goods industry is very interested in pursuing organic and natural fragrances in end products,” said Smith.

Yet he pointed out that, of a typical ∼1,500-material perfumer’s palette, about 31.2% are synthetic, 24% natural, 11% nature identical and just 0.05% truly sustainable. The increased availability of natural and organic ingredients of course provides perfumers more hedonically acceptable products, he said, but there remain problems with coloration, limits of certain notes such as musks, allergens, cost, etc. Meanwhile, numerous crops suffer cyclical failure (patchouli) and political and social upheaval (sandalwood). Smith stressed that fragrance houses should constantly review prices with customers and even institute “creative” pricing of finished products. “Classical margins do not apply to force majeur materials,” he noted, and encouraged fragrance suppliers to break these materials out when presenting costs to customers. Finally, Smith identified an inverse relationship between the marketability of natural and organic products and their cost. Despite this, said Smith, there remain ample opportunities in the categories of green, eco-friendly, renewable, recyclable, fair trade and sustainable products.